Hi, I’m Adil Wali. I became a Microsoft certified professional at age 14 and started my first web development company. That led to a career as a serial entrepreneur, advisor, and startup investor. I got my first “real job” at 33, and I’m now a FinTech executive with a passion for the markets.

Anonymity is not the same as obfuscation

Cryptocurrencies have generated a lot of excitement over the last year or so, especially with the phenomenal price surges experienced in 2017. The ability to conduct peer-to-peer transactions through the blockchain has an added attraction. It cuts out government intervention and the role of third parties such as banks and financial institutions.

However, apart from all the current hype around digital currencies, there is one major misperception about this market; most people believe that cryptocurrency transactions are fundamentally anonymous. Nothing could be further from the truth and, apart from a handful of the hundreds of cryptocurrencies on the market, most of them do not provide anonymity.

The danger here is that most people entering this market do not understand the core technology. We get carried away on the wave of hype without checking our facts, making us vulnerable to misinformation spread by currency traders.

How Much Can We Hide?

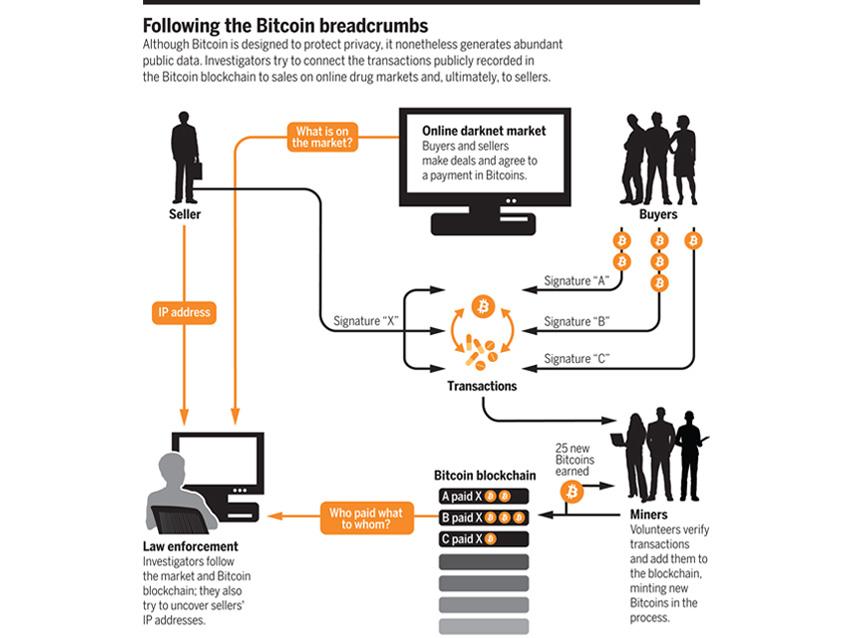

Blockchain, the platform for cryptocurrency exchange, is antithetical to anonymity because it is designed to be fundamentally transparent. The intention is to make all transactions available for public scrutiny while protecting our privacy. However, this doesn’t mean that they are anonymous; at best most cryptocurrencies integrate a level of obfuscation to obscure the origin of transactions and make them harder to follow.

Blockchain technology uses ledgers with public addresses to facilitate transactions, which are encrypted 34-bit alphanumeric strings recorded on the blockchain. This technology gives us a false sense of security.

Hiding identity on digital networks can be difficult and we often leave digital footprints in our transactions. Even though cryptocurrency transactions do not link directly to a person’s identity, physical address or email, this information can be tracked through IP addresses. Our identity can also be traced if we use a private Wi-Fi connection

Bitcoin: A Case in Point

Bitcoin transactions are not anonymous and can be tracked, even though blockchain encryption enables a level of obfuscation to provide some degree of financial privacy. The Bitcoin infrastructure is designed around a distributed, global database which stores every single transaction that takes place in the system.

We can use Bitcoin software to create a new public key, using it as a pseudonym to transact without registering personal information. The problem is that pseudonymity does not mean anonymity, and our identities can still be tracked.

Bitcoin’s answer to this problem is to use a number of obfuscation techniques to enhance financial privacy. One of these is referred to as “ambiguating obfuscation” which reduces the amount of information that a person can gather from a transaction. This could involve the use of a new pseudonym for every transaction.

Another type of obfuscation, “cooperative obfuscation”, has become popular with users to fudge the origin of transactions. This can be done by mixing funds with other users through a service provider to obfuscate the flow of payments.

Other cryptocurrencies, or altcoins, have built stronger platforms in terms of privacy. As the original cryptocurrency, Bitcoin had to field much of the criticism by government of blockchain’s potential use by criminal elements for nefarious financial transactions. As a result, Bitcoin has opted to strike a balance on privacy levels to avoid a government crackdown.

Bucking the Trend

While many people don’t see anonymity as a big deal, others value their financial privacy. To cater to the privacy conscious, there are several cryptocurrencies that focus on providing an enhanced level of anonymity:

- Monero. This cryptocurrency was launched in 2014 as a fork of ByteCoin and provides one of the highest levels of privacy in this market. While it uses the same basic transactional framework as Bitcoin, Monero uses ring signatures and address derivation to increase anonymity.

Ring signatures obfuscate all the details of transactions, including origins, destinations and transaction amounts. Every transaction is signed and time-stamped with a ring signature, which is verified against a group of public keys while protecting the identity of the actual private key used in the transaction. This means that Monero blockchain transactions cannot be linked to a specific user.

- Zcash. Zcash is an open-source cryptocurrency launched in 2016. While payments on the public blockchain are published, the sender, recipient and transaction amount remain private.

Zcash uses zero-knowledge proofs, built on advanced cryptographic techniques, to verify transactional validity without revealing key information. This enables the network to maintain a secure ledger without revealing parties or amounts involved in the transaction.

- Verge. Verge is another open-source digital currency that models itself on Bitcoin. However, Verge uses multiple anonymity-centric networks to keep IP addresses obfuscated and ensure the privacy of transactions.

- Dash. This cryptocurrency model offers a decentralized mixing service, called PrivateSend, that enables the merging of funds. Funds and payments are mixed together on this platform so that an investigator cannot detect the sender, destination of amount.

Nefarious Bitcoin Dealings

Of course, there have been ventures in the cryptocurrency space that have almost ruined its reputation. Who can forget the notorious Silk Road bust? This was an online marketplace for drugs and Bitcoin was its lifeblood. It was shut down by the U.S. Justice Department in 2013, and its creator, Ross Ulbricht, was jailed for life. In 2017, the department claimed the proceeds from the sale of 144,336 Bitcoins, valued at over $48 million.

In more recent times, Floridian, Anthony Murgio, was sentenced to five and half years for operating a Bitcoin exchange connected to hackers. This was used to launder more than $10 million worth of funds. In addition to these cases, illegal operations involving Bitcoin have been detected in other parts of the world, including Russia and Malaysia.

So What’s the Big Deal About Anonymity?

Although we can understand the need some people have for financial privacy, for the majority of users in the cryptocurrency space anonymity is not such a big deal. Well, it’s not their overriding consideration when choosing a cryptocurrency. Can you think of any non-nefarious uses that demand anonymity?

Whether you’re particular about anonymity or not, please, please, please, before you invest in a digital asset, I implore you to check some of your core assumptions about how it works. Digital currencies are very exciting, and many of us believe that this is just the beginning of something really special. That’s all the more reason to be judicious, thoughtful and measured when making investments in this space.

References:

Emma Avon, Coincodex, 2017. https://coincodex.com/article/66/top-5-cryptocurrencies-for-anonymity/

Sudhir Khatwani, Coinsutra, 2018. https://coinsutra.com/anonymous-bitcoin-transactions/

Rishav Chatterjee, ResearchGate, 2017. https://www.researchgate.net/publication/320755472_Anonymity_and_the_Obfuscation_Issues_in_the_Cryptographic_Currency_Bitcoin

Masterthecrypto. https://masterthecrypto.com/privacy-coins-anonymous-cryptocurrencies/

Reuben Yap, Zcoin, 2017. https://zcoin.io/the-difference-between-privacy-on-the-blockchain-and-hiding-your-ip-address/

J P Buntinx, Digital Money Times, 2014. http://digitalmoneytimes.com/cryptocurrency-open-ledger-vs-anonymity-obfuscation/

Andrew Norry, Blockonomi, 2017. https://blockonomi.com/history-of-silk-road/

Benjamin Vitaris, Bitcoin Magazine, 2017. https://bitcoinmagazine.com/articles/operator-illegal-bitcoin-exchange-coinmx-sentenced-prison/