Hi, I’m Adil Wali. I became a Microsoft certified professional at age 14 and started my first web development company. That led to a career as a serial entrepreneur, advisor, and startup investor. I got my first “real job” at 33, and I’m now a FinTech executive with a passion for the markets.

Why Crypto?

Easy money through loose monetary policy and increased trade war pressure have created a credibility problem for central banks and governments behind major national currencies. That’s bullish for major cryptocurrencies, which have emerged as alternative stores of value, according to some cryptocurrency experts.

Alex Karasulu, Co-Founder and CEO of OptDyn, is one of them. “In the 20th century, we saw the dismantling of gold-backed sovereign currencies paving the way towards fiat currency manipulation and other kinds of central bank practices such as quantitative easing,” says Karasulu. “The gold standard kept us straight in terms of spending, debt, and limited the options available to central banks. These factors in concert now with the gradual erosion of globalism and the recent rise of trade wars applies added pressure to manipulate fiat currencies.”

This trend is most evident in the intensifying US-China trade war. The two countries have been manipulating their currencies to make-up for failed trade talks, according to Karasulu. “We saw this dynamic with the reactionary drop in the Chinese Yuan with failed trade talks,” he says. “The US is doing the same, but through an indirect method by dropping interest rates, which worsens the debt spiral as money gets cheaper to loan. ”The result? “The people don’t have faith in the independence of central banks anymore,” continues Karasulu.

“People are worried about the instability of traditional currencies – I’ve seen an uptake in crypto in the UK to hedge against the loss in the pound,” says Richard Dennis MSc, CEO and Founder at temtum. “A lot of people have lost trust in the government so they are putting their cash into non-government or company controlled coins.”

Like Bitcoin and other major cryptocurrencies. “Monetary policy based on math, and not government officials or agencies, is starting to sound more appealing to investors, says Chris Reinertsen, Chief Marketing Officer of Rhythm Technologies. “Bitcoin has been designed to be an eventual safe haven from government controlled currencies since its inception, but as trade and currency wars are being waged, more and more investors are looking for alternatives to avoid repeats of the last major bear market.”

Karasulu agrees. “The obvious appeal of Bitcoin and other cryptocurrencies are their immunity to manipulation, and unlike gold, or other precious metals, there’s no physical issue of safekeeping. No institution can siphon away the value of the Bitcoin you hold,” he notes. “No quantitative easing will ever take place. No country will devalue it in a currency war over trade tensions.”

Economists at global investment bank Goldman Sachs believe there to be no end in sight to the ongoing US-China trade war. Although damaging to economic interests in both nations, the lack of resolution may well be bullish for Bitcoin. According to a report in Reuters, a note to clients sent out recently by Goldman Sachs states that the bank is expecting that the US-China trade war won’t be resolved before the 2020 presidential election. Economists from the global banking giant also stated that they believed a recession to be likely.

Goldman Sachs believes the 10 percent tariff on the last $300 billion of Chinese imports will go into effect, as planned, on September 1. In response, China has threatened to stop buying US agricultural products. The bank does not think a resolution likely in 2019.

As part of the ongoing trade war, the US has accused China of manipulating its currency to damage the profitability of American exports. China denies doing this. Whatever the cause, the yuan has been depreciating in value against the dollar a lot as of late. Such economic conditions have caused some Bitcoin analysts to speculate that the recent run up in the value of the cryptocurrency has been caused by members of the Chinese public wanting to protect the purchasing power of their savings against the devaluing yuan.

If such a theory is correct, Bitcoin may benefit greatly from the continuation of the trade war and a recession following it. If capital has already been flowing from the yuan to BTC, it stands to reason that it would continue during a prolonged trade war.

How safe is Bitcoin?

“In a slowdown, since the global economy is so interconnected, there are only a limited number of assets that are isolated,” Evan Kuo, CEO of Ampleforth, a digital asset protocol, told Markets Insider in an interview. To that end, bitcoin is not subject to the same forces as normal currency. This is why people who feel less trust towards the government see it as an alternative, said Aries Wang, cofounder of Bibox, a digital asset exchange that uses artificial intelligence technology.

But there’s a catch: bitcoin and other cryptocurrencies are quite volatile. Take recent trading for example. Even after bitcoin soared above the $12,000 level on global macro fears, it has since fallen back below the $10,000 threshold. Still, Kuo says that this volatility can be a plus, so long as it’s not tied to the same forces driving stocks and bonds.

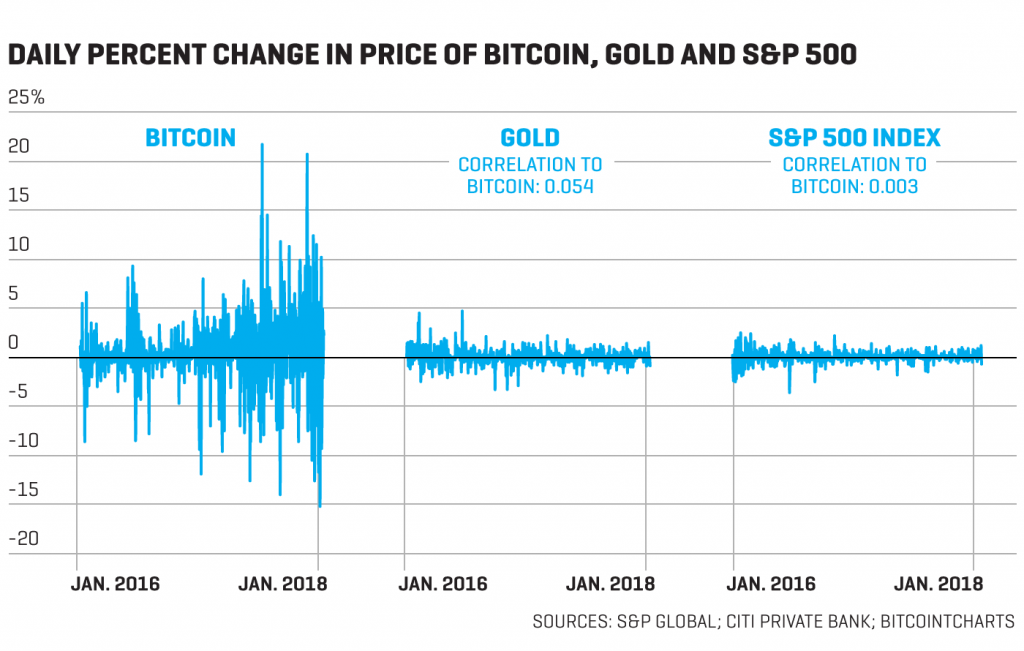

“It’s helpful that it’s volatile in a way that’s not connected to other assets,” said Evan Kuo, CEO of Ampleforth, a digital asset protocol, told Markets Insider in an interview. “There’s been almost 10 years of data to suggest that the coin has almost no risk exposure to precious metals, commodities, equities, currencies, and so on.”

Having an uncorrelated asset can be a good way to balance a portfolio, Kuo said. And he thinks, compared to other safe-haven assets, there’s more opportunity to generate a greater return with bitcoin. For example, he points out that an investor could have higher returns in bitcoin than gold, another safe haven asset that has hit recent highs. There’s more risk involved, Kuo said, but that’s worth it to some investors for a higher reward.

Countries experiencing currency issues have seen bitcoin trade at a premium on local exchanges, according to Daniel Dixon, cofounder of Interdax, a cryptocurrency trading platform focused on derivatives. In Venezuela and Argentina, two countries where political tensions have led to inflation and poor economic conditions, bitcoin trading has picked up, he told Markets Insider in an interview.

Despite the recent growth in global uncertainty, isolationism, and other driving factors, not everyone agrees that bitcoin — or even safe haven assets broadly — are a good bet right now. “They are collectibles,” Dev Kantesaria, portfolio manager of Valley Forge Capital Management told Markets Insider in an interview, referring to both bitcoin and gold. “You are actually not buying any protection, you’re simply speculating. To me, it’s no different than any other speculative activity in your life.”

Bitcoin has fundamental structural issues, he said, and one is its limited use today. Few would sell their house, car, or laptop for bitcoin he said. In addition, he thinks that buying assets that don’t yield much in the way of returns is unproductive. “You have to think about lost opportunity and lose buying power when buying gold,” he said. Even though US markets have been up and down as of late, he is still very bullish on equities for the next five to 10 years, he said.

Will practicality matter?

While there are a number of global factors that warrant a closer look at crypto, there is at least one potential achilles heal that comes to mind: practicality. Bitcoin, while fundamentally deflationary and provably resilient to meddling hands by design, is not actually being used in the way that it was designed.

Satoshi mentioned in her whitepaper more than 10 years ago that one of the core tenants of bitcoin was that it eliminated the reliance on a trusted third-party. While, this is technically true at the protocol level, the reality of human-nature and real-life usage seems quite different. The supermajority of crypto users utilize custodial exchanges such as Coinbase, Gemini, or Binance. These exchanges operate precisely in the manner that Satoshi was trying to reinvent — they are trusted third-parties that hold our funds on our behalf.

This has been, perhaps, one of the most puzzling things about the crypto “revolution” to me. Even though the primitives in the protocol allow us to think differently about how funds are held and managed, we don’t actually use it that way. The fervor in the community is around re-inventing the banking system with a thing that looks a lot like… banking.

In fairness, this is for good reason — the reality of a bearer currency (where one who acquires the keys has complete control over of the funds) is, in many ways, an ode to the past. It reminds me of a time when you wanted to bury gold in your backyard and invest in security to keep your funds safe — because no one would have kept them safe for you. Perhaps the most important question here is, “does the bull thesis for crypto make sense unless we go back to the future, to a world where it’s every person for themselves?”