Hi, I’m Adil Wali. I became a Microsoft certified professional at age 14 and started my first web development company. That led to a career as a serial entrepreneur, advisor, and startup investor. I got my first “real job” at 33, and I’m now a FinTech executive with a passion for the markets.

When explaining bitcoin’s latest run of price appreciation, several analysts emphasized concerns surrounding the trade war, contending that economic uncertainty was driving investors to the digital asset as a potential disaster hedge.

“Bitcoin has the ability to act as a more safe haven asset, and signs of a further deteriorating trade war with China could have been the primary catalyst to drive up bitcoin prices following Trump’s tweet,” said John Todaro, director of digital currency research for TradeBlock. Charles Hayter, co-founder and CEO of digital currency data platform CryptoCompare, provided a similar point of view, stating that “the trade war gives bitcoin credence in its digital gold guise”.

China and National Cryptocurrency

After a short stay in the red zone, Bitcoin has recovered toward $10,000 – $12,000 price range, with traders turning bullish. Experts call the United States-China trade war a key reason for the main cryptocurrency’s price fluctuations. Fuel to the fire has been added by the recent announcement by the People’s Bank of China (PBoC) of plans to get ahead of the U.S. and Libra by issuing a national cryptocurrency.

On the 2nd of August during a video conference devoted to discussing financial tasks for the second half of 2019, heads of financial and economic institutes in China touched upon the topic of cryptocurrencies. The country’s central bank announced its intention to accelerate the development of its own digital currency and also confirmed its plans to allocate more resources to the implementation of this task.

In July, Wang Xin, director of the PBoC Research Bureau, said that, with the development of the Libra cryptocurrency project, the People’s Bank of China should accelerate the growth of its own digital currency, which it has been working on over the past few years. Wang believes that the risks Libra bears for the traditional financial system will force regulators to devote many more resources and forces to develop its digital currency.

According to Wang, PBOC has been paying “high attention” since Facebook released in a white paper in June that outlines plans to create a cryptocurrency and a related blockchain-based financial infrastructure. PBOC was the first major central bank to study digital currencies in 2014 – a step to counter the challenge from cryptocurrencies like bitcoin – with a research institution set up in 2017 to further facilitate the research.

China maintains a blanket ban on new listings or trading of any digital currency, including bitcoin, as Beijing regards digital tokens as a source of financial risk. At the same time, China’s central bank has been longing for a “sovereign” digital currency that would fall under its control, although it has so far made little progress.

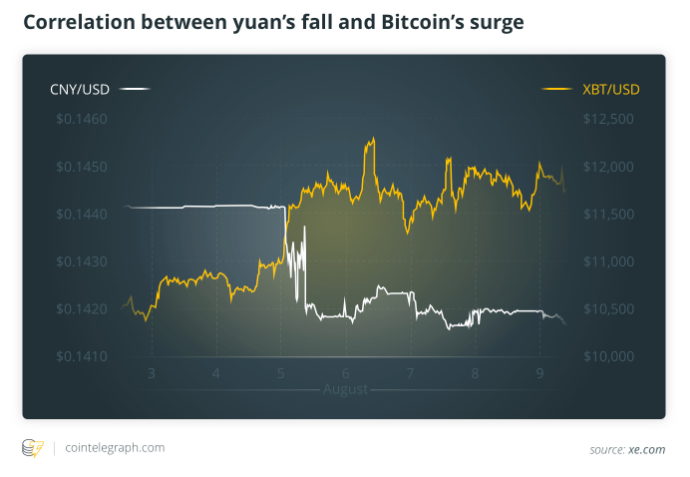

Analysts have drawn parallels between the declining rate of the yuan and Bitcoin’s growth. The price of the preeminent digital currency rose sharply the very moment when the Chinese currency fell by 7% to an 11-year low. On the 5th of August, Bitcoin’s price surged to $11,786, with the daily increase amounting to an 11% gain.

U.S. President Donald Trump alleged on Twitter that the Chinese government is manipulating the price of the renminbi:

“China dropped the price of their currency to an almost a historic low. It’s called ‘currency manipulation.’ Are you listening Federal Reserve? This is a major violation which will greatly weaken China over time!”

As financial analysts suggest, the renminbi declined due to investors’ concerns over a new round of escalation in the trade war between China and the U.S. This happened a few days after Trump introduced additional tariffs on goods imported from China. Now that U.S. products could become more expensive for Chinese consumers, a lower exchange rate might adversely affect U.S. exporters. The prices of U.S. stock futures have already declined, while the cryptocurrency market has showed a propensity to move in the opposite direction.

Some analysts have postulated that the reason for this dynamic could be because Chinese investors use Bitcoin as a means of saving money. Simon Peters, an analyst at trading platform eToro, suggested that Chinese investors could want to diversify as the yuan fell. According to Peters:

“Given that Chinese investors make up a large proportion of crypto investors, there’s a strong possibility some are backing bitcoin’s chances against the yuan.”

However, Peter Schiff, an economist and CEO of brokerage company Euro Pacific Capital, rejected this explanation, claiming it was more about speculation rather than about real need:

“CNBC is trying its best to dupe its audience into buying Bitcoin. Despite gold being a much larger market, CNBC devotes far more airtime to Bitcoin. The Chinese aren’t buying Bitcoin as a safe haven. Speculators are buying, betting that the Chinese will buy it as a safe haven!”

These multiple points-of-view seemingly explain the oscillation of Bitcoin’s price as it continues to hover around the support and resistance line of $10,000. Time will tell us which way the currency will break. For now, I’m long.

In the next part in this series, I plan to cover Bitcoin as an alternative to gold.