Hi, I’m Adil Wali. I became a Microsoft certified professional at age 14 and started my first web development company. That led to a career as a serial entrepreneur, advisor, and startup investor. I got my first “real job” at 33, and I’m now a FinTech executive with a passion for the markets.

In the wake of this year’s Black Friday/Cyber Monday stats, I want to talk about mobile commerce: the truths, the questions, and the abundant opportunities. I’ll be honest, the importance of mobile commerce isn’t escaping anyone playing the eCommerce game. In fact, it may be the most agreed upon movement out there — consumers spend a lot of time on their phones so eCommerce apps need to be available to them. And there are tons of stats to support the growth of mobile, particularly after the past four days.

Some background stats

According to IBM, Black Friday mobile traffic increased 34% over 2012 to make up 39.7% of all online traffic and mobile sales constituted 21.8% of online sales. Cyber Monday was also strong in mobile, showing 31.7% of all online traffic and 17% of sales. The breakdown of smartphones to tablets was interesting too:

“Smartphones drove 24.9 percent of all online traffic on Black Friday compared to tablets at 14.2 percent, making it the browsing device of choice. Tablets drove 14.4 percent of all online sales, double that of smartphones, which accounted for 7.2 percent of all online sales. Tablet users also averaged 15 percent more per order than smartphone users, spending on average $132.75 versus $115.63 for smartphone users.”

Compared to Cyber Monday:

“Smartphones drove 19.7 percent of all online traffic compared to tablets at 11.5 percent, making it the browsing device of choice. When it comes to making the sale, tablets drove 11.7 percent of all online sales, more than double that of smartphones, which accounted for 5.5 percent. On average, tablet users spent $126.30 per order compared to smartphone users who spent $106.49.” (Read the full Black Friday and Cyber Monday reports).

The Big Question

So what does this all mean? We know phones and tablets are important in the future of eCommerce, but what should companies actually be doing about it?

Differentiating Web from Mobile

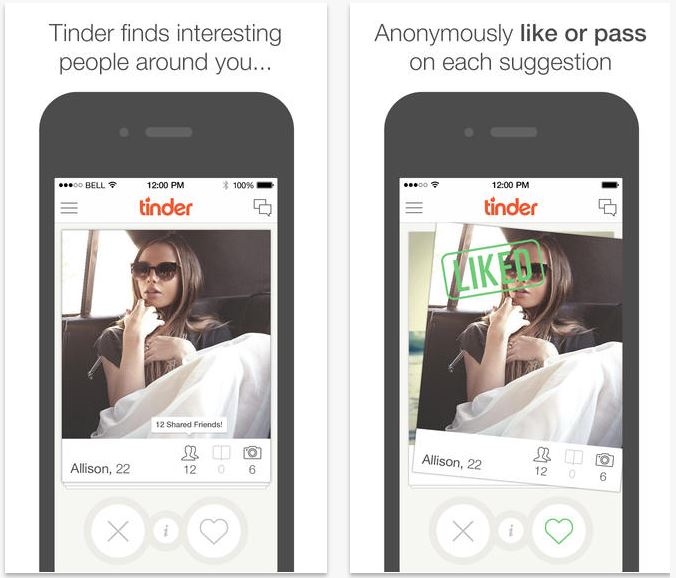

Despite universal acknowledgement that mobile apps are increasingly important for eCommerce companies, those apps continue to be viewed as just paired-down versions of web apps. They’re not. Thinking about tablets and smartphones as smaller versions of desktops is a dangerous game: Best Buy and Sony Style both failed to adapt their sites to tablet users and lost out on Cyber Monday (Mobile Commerce Daily has a good article about this). On the other hand, dating site Tinder is crushing it in the mobile sphere by creating an app that is NATIVELY mobile. Users swipe though potential matches instead of clicking or scrolling.

But what about eCommerce sites? Some retailers are certainly catching on. Both REI and Nine West have created mobile apps that are meant for use in store. They recognize that shoppers want to be able to compare products in real time. The REI app has a product scan option where shoppers can scan the bar code of any product in store to see details and customer reviews. Nine West now provides in-store ipads with an app from which shoppers can browse, see details and reviews, and then order online, all while still being able to try on the item in-store.

Mobile apps offer incredible opportunities for marketing and personalization. Cache is doing this right. They’ve adapted their push notification system to respond to shoppers habits. If a shopper generally browses certain parts of the site, they get notifications about specific items that they may have viewed. And, like REI, the Cache app also offers in-store bar code scanning.

There is so much opportunity inherent to mobile shopping; retailers need to remember that having a mobile app does not mean having a responsive web page.

Showrooming vs. Webrooming

Brick and Mortar isn’t disappearing anytime soon. But the growth of mobile shopping means that eCommerce and B&M don’t need to be in constant competition. If showrooming and webrooming are growing trends, mobile apps and in-store tablet implementations could help companies create harmony between the two. eCommerce companies should be looking to build better cross-channel experiences as Nine West is doing. Moreover, companies should think about offering incentives to customers browsing online — if the customer webrooms on his phone, why not offer him a promo when he walks into the store? Promotions could work across channels, providing incentives for shoppers to be interacting with retailers on multiple channels, thereby increasing exposure.

Coming up in Mobile eCommerce, Part Two:

Mobile Behaviors and a few questions to turn things on their head.