Hi, I’m Adil Wali. I became a Microsoft certified professional at age 14 and started my first web development company. That led to a career as a serial entrepreneur, advisor, and startup investor. I got my first “real job” at 33, and I’m now a FinTech executive with a passion for the markets.

To me, there are two business models that work at-scale in consumer internet. The first is advertising and the second is payments. I was thinking recently about how many companies are starting to think actively about payments as both a business model and a way to provide convenience to their users.

In this post, we explore this notion further by looking at the digital payment solutions and services that are provided by the companies in the S&P 500 Index, which consists of the 500 large-cap companies that are traded on different American Stock Exchanges. In a future post, we’ll examine the implications of these strategic moves each company is making.

Alphabet / Google

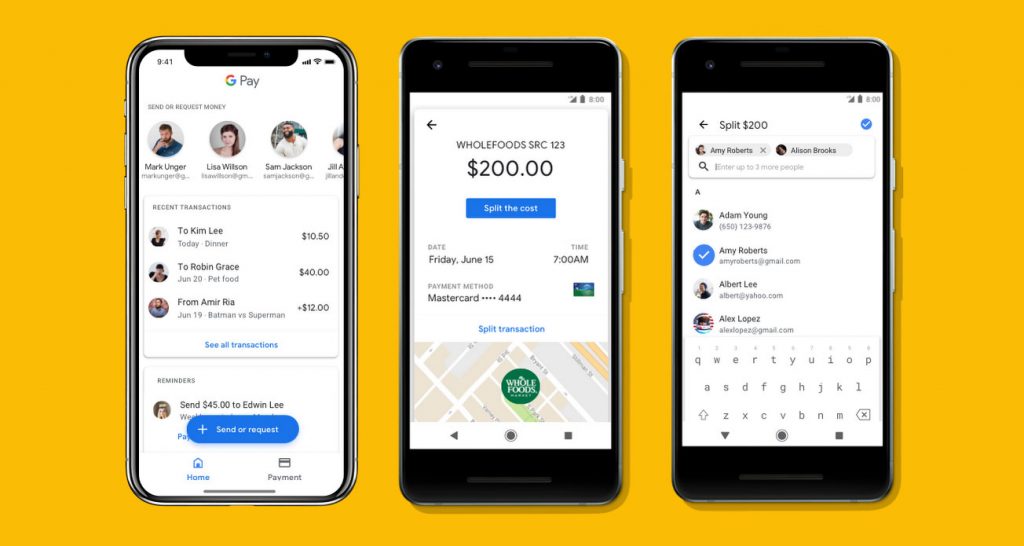

Google Pay is a digital wallet platform and online payment system developed by Google. It allows in-app and tap-to-pay purchases on different mobile devices and it has a variety of features:

For customers:

- Supported by major banks in the US and other 28 countries;

- Integrated with several mobile banking apps across the globe;

- Use for in-store, in-app and online payments;

- Accepted in over a million stores that accept NFC payment;

- Can be used for tickets, boarding passes, and transit cards;

- Multiple layers of advanced security to prevent fraud and malicious attempts;

- Allows to send money or request for cash in the app;

- Transfer of money to your bank account without having to cash out.

For merchants:

- Easy online integration with Google Pay API;

- Easy checkouts, which can lead to higher cart conversion and increased sales;

- Better brand affinity, traffic and customer engagement;

- No extra fees (beyond payment processing);

- Enhanced security against exposure to fraud.

Advantages of Google Pay:

1. Major network support: supported by all the 4 major networks in the US and by hundreds of different big banks and credit unions. Mastercard, Visa, American Express and Discover also support Google Pay. Moreover, through strategic partnerships, websites that support Masterpass and Visa Checkout now also work with Google Pay.

2. Mobile Banking App Integration: partnerships with several banking apps allows users to add their cards to the app by simply tapping a button.

3. In-App and Online Purchases: Google Pay can be used for making in-app purchases, and some of the apps already support in-app and online purchases.

4. Boarding Passes & Tickets: some companies like Singapore Airlines, FortessGB, Eventbrite, Southwest, and Ticketmaster support the storage of a digital ticket or boarding pass on your phone.

5. Enhanced Security: the app does not store your card’s number, also, it will not appear on your device or in any of the apps, websites or terminals you’ve transacted with. The cards come with a secure encryption technology meant to protect your confidential data from being compromised.

6. Availability in various countries: at this moment Google Pay works in 29 countries for making in-app and contactless purchases, provided that you’re using a compatible device and cards.

Disadvantages of Google Pay:

1. Not always accepted: not all stores at this moment trust mobile payments. While major retail stores and chains accept it, smaller retailers prefer to use classic payment methods, and even NFC POS terminal in the store is not a guarantee that Google Pay will be accepted there.

2. Limited only to NFC technology: Google Pay works only with NFC and does not support MST terminals, also, not all mobile phones have integrated NFC technology in them or just don’t work properly with it.

3. All transactions depend on your mobile device: in case you lost your smartphone or smart watches or the battery dies on the device, you will not be able to pay using Google Pay.

Amazon

Amazon Pay was formerly called Amazon Payments and Pay with Amazon. It replaces older services, including Checkout by Amazon (for online sellers of tangible, physical goods) and Amazon Simple Pay (for digital goods such as e-books or software). Amazon Pay is currently available to merchants in the United States, Japan, and the European Union.

Main features of Amazon Pay:

1. Inline checkout: clients can enter payment information and complete purchases without having to leave your website. This is convenient for the customer and also increases the likelihood of completing a sale.

2. Automatic payments: Amazon Pay supports recurring payments and automatically renewing subscriptions.

3. Fraud protection technology: this free service is the same technology used by Amazon to secure accounts from fraudulent transactions, reducing your costs and protecting your business. Moreover, Amazon Pay grants merchants a Payment Protection Policy, which states that merchants may waive chargeback fees for qualifying fraudulent transactions.

4. Voice Solutions: allows customers to make purchases or donations through their Alexa devices. It can be done by creating an Alexa Skill and adding Amazon Pay to the skill to enable voice purchasing.

5. Charitable Donations: collection of donations through Amazon Pay.

6. Multiple Integration Options: Amazon Pay presents many ways of integrating Amazon Pay with your selling platform. These integrations vary from plug-and-play options that are built into popular eCommerce software to custom solutions that meet the needs of enterprise businesses. You are free to choose the integration that best suits your businesses and technological know-how.

Apple

Apple Pay is a digital wallet that lets you pay for goods by moving your iPhone over a contactless reader, removing the need to use a physical card or enter a PIN. I’ll work up a more detailed post about Apple Pay and post it soon.

Security of Apple Pay:

The details of the added card are encrypted and stored only on your iPhone; not on Apple’s servers. Apple replaces your card’s details with a thing called a device account number (a token) which means that your actual card information is never shared during purchases.

A passcode and Apple’s fingerprint-recognition (Touch ID) or facial-recognition (Face ID) technology adds another layer of security. On Apple Watch, wrist detection must be enabled. If you lost your phone or it was stolen, you could stop payments by logging in to Apple’s iCloud or by putting your device into ‘lost mode’ via the ‘Find My Phone’ app.

How it’s being used?

Your phone doesn’t need to have a connection to the internet to make a payment in-store. Your card details are stored securely on your iPhone or Apple Watch, so you only need to hold it close to the contactless reader, just as you would if you were paying with a contactless card. A fact that a payment has been made will be confirmed by a vibration.

If you’re using an iPhone you’ll be required to use Touch ID when making a purchase. If the phone doesn’t recognize your fingerprint, then the transaction won’t go through. Apple Watch doesn’t require you to do this — you have to just place your watch next to a reader to make a payment. Shops will be able to refund any purchase made with Apple Pay under the same terms as paying with a physical card (cashiers may ask for the last few digits of your Device Account Number to process returns).

If you need a receipt, you can just ask for it the same way you would when paying via credit or debit card. You’ll be able to view your most recent transactions for each card in the Wallet app. You can also pay for goods on the web in Safari using an iPhone, iPad, or Mac. For Macs without Touch ID, make sure you’ve turned Bluetooth on. Apple Pay will store your billing, shipping, and contact information so you won’t need to enter it again.

Main Apple Pay Features:

- Send & Receive Money

- Siri Send & Receive Assist

- Bank Account Transfer

- Face ID Authentication

- Touch ID Authentication

- Passcode Authentication

- Web Store Transactions

- In-App Transactions

- In-Store Payments

- Returns Processing

- Rewards Program Integration

Disclaimer: I work for Facebook, in Payments! I asked a friend to help me draft this section so that I could do it only with public information and without bias!

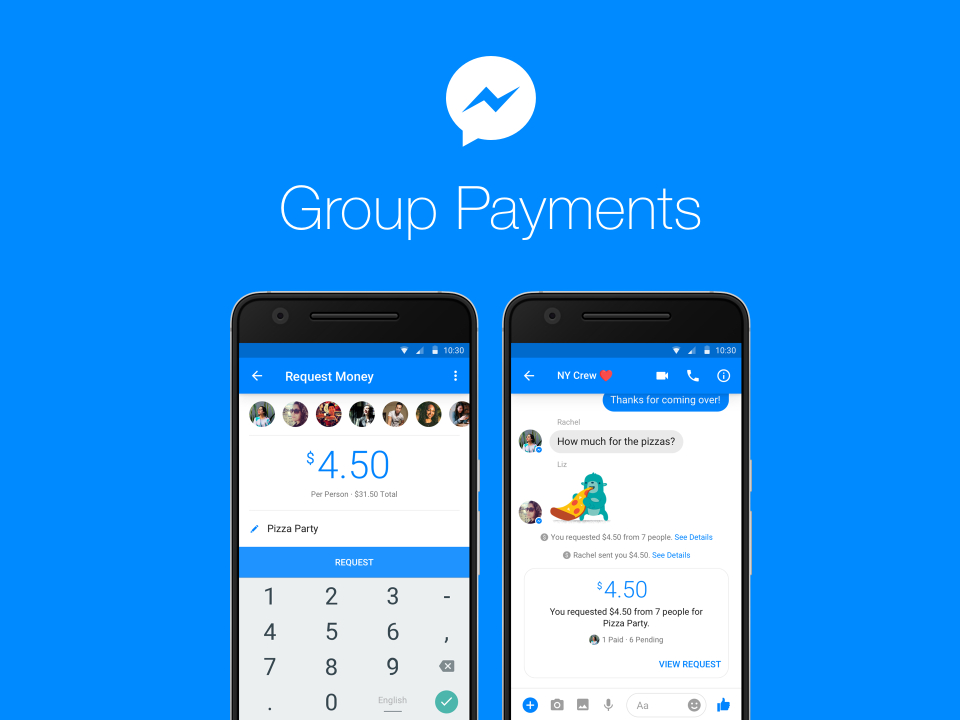

Facebook Payments were introduced in 2015 as part of the Messenger app and benefits from the convenience factor of most people already having the Messenger app downloaded. People can use it to quickly split a bill or pay back a friend.

Using the payments feature in Facebook Messenger does not use an online wallet or vault, like Venmo does; all of the money you transfer goes directly to the recipient’s debit card or PayPal account that they’ve attached to their Facebook account. You can’t directly link a bank account, but you can have it go to your bank account via a debit card.

There are no extra steps or fees to have the money placed directly in the recipient’s possession, just as if you had physically handed them cash. Also, Facebook has introduced a few neat additions to the basic cash transfers, including “Group Payments” so your squad can all pitch in right there in the group chat.

Garmin

This was one that I didn’t expect to see in doing my research. Garmin Pay is a contactless payment solution designed for people who are always on the move. Whether you grab a cup of coffee after your morning run or get a bite to eat while out on a ride, Garmin Pay lets you make purchases quickly and almost effortlessly with nothing needed but your watch.

It’s worth to mention that Garmin takes the security of your payment information seriously. That’s why Garmin Pay protects you by using watch-specific card numbers and transaction codes every time you make a purchase. And your card number is not stored on your device, on their servers, or passed to merchants when you pay.

With Garmin Pay, you can keep making purchases with the same cards you use every day. Garmin Pay works with many major credit and debit cards, including Visa and MasterCard. Just add them to your watch’s digital wallet, and then continue taking advantage of the perks and rewards your card offers.

Services like Google Pay, Apple Pay and Samsung Pay now have many banks around the world supporting the platform, but like Fitbit Pay the Garmin alternative is currently quite limited. You need to first check that Garmin Pay is available in your country. It’s currently available in the UK, US and Australia.

Microsoft

Microsoft Pay (previously known as Microsoft Wallet) is a mobile payment and digital wallet service created by Microsoft. This solution allows users to make payments and store loyalty cards on certain devices.

Microsoft Pay does not require Microsoft Pay-specific contactless payment terminals and can work with existing contactless terminals if used on different mobile devices. Similar to Android Pay, Microsoft Pay uses Host card emulation (HCE) for making in-store payments. Also, making payments is currently supported on the Microsoft Edge browser.

The Microsoft Pay service adds a Microsoft Pay link to merchants’ sales agreements or invoices so customers can easily pay using Microsoft Pay. They can send the documents by email to provide one frictionless way to pay. This should also benefit the merchant, who should see funds arrive in their bank account faster as a result. This extension seems like it could create a really meaningful use-case, where merchants can easily embed a Microsoft Pay link with their invoices or contracts.

Walmart

Walmart Pay was introduced to the public in December 2015. Initially available in only a small number of stores in Northwest Arkansas, a nationwide rollout of Walmart Pay to all 4,600 stores was completed in July 2016.

About 140 million Americans shop at Walmart each week, and the Walmart app with Walmart Pay feature is already used by 22 million customers as they shop each month. There is no concern amongst these customers about forgetting to use this mobile app and they can be sure that the store accepts the payment method.

Figures released by Walmart confirm the initial success of the service: payments made through the Walmart app jumped 45% following the rollout, with 88% of the transactions coming from repeat users. The mobile app has received great reviews, with 82% of users claiming they would recommend Walmart Pay, and 75% awarding five stars in app stores.

What does it all mean?

It’s clear that payments are being taken seriously as both a product offering and strategy amongst top technology companies here in the United States. It feels like we see a meaningful announcement or initiative from a large tech company every month (or, at least, every quarter.) While the offerings are clearly meaningful and growing in scope, an important question remains: How do these solutions provide a meaningfully higher-level of convenience or a better experience than their classic payments counterparts?

Here in the US, the payments infrastructure is pretty mature (eg., a large percentage of the population uses credit cards and has bank accounts.) So, the challenge for payments solutions here is to increase the convenience or value meaningfully beyond what we already have. In some emerging markets, for example, the payments infrastructure is less mature. In those markets, these new solutions won’t be competing with existing credit and debit cards quite as much. These different landscapes will likely affect the offerings required to “win” the market. I’ll plan to dig more into emering markets soon!