Hi, I’m Adil Wali. I became a Microsoft certified professional at age 14 and started my first web development company. That led to a career as a serial entrepreneur, advisor, and startup investor. I got my first “real job” at 33, and I’m now a FinTech executive with a passion for the markets.

Before I begin, I want to give a quick shout out to Clay Allsop at Propeller for pointing out that there are companies out there helping retailers and shop owners differentiate their mobile and web platforms. I’m excited to see the cool implementations that may result.

Quick Recap

I left you on Wednesday with some thoughts about what I think this year’s Black Friday and Cyber Monday numbers mean for the future of mobile commerce. In particular, I touched on the importance of not looking at phones and tablets as smaller versions of the web as well as what the growth of showrooming and webrooming means for the relationship between Brick and Mortar and eCommerce (for more general insight into the future of B&M vs. eCommerce as I see it, check out this post).

Today, I want to move away from the businesses themselves and look to the consumer. How does consumer behavior change when using phones vs. tablets vs. computers?

Measuring Mobile Behaviors

Ok, I’ll get to the consumer, but first, I want to talk about how we measure behaviors. My first question in thinking about all this is “Where’s the proof?” Everyone talks about how important it is to have a good mobile site, and the numbers certainly show an increase in mobile sales as well as traffic, but WHO is downloading your app? Is anyone actually acquiring NEW customers via the mobile channel, or are web customers simply adding a new channel/migrating over? So far, I don’t know that we have any way to measure this consistently, but it would be a useful statistic to have. Particularly since it would provide interesting commentary on the significance of mobile commerce as a tool to strengthen either CLV or CPA. (I have some strong opinions and probing questions on where these two are going to end up in the equation of success, stay-tuned for a post on this one).

Consumer Mobile Behaviors

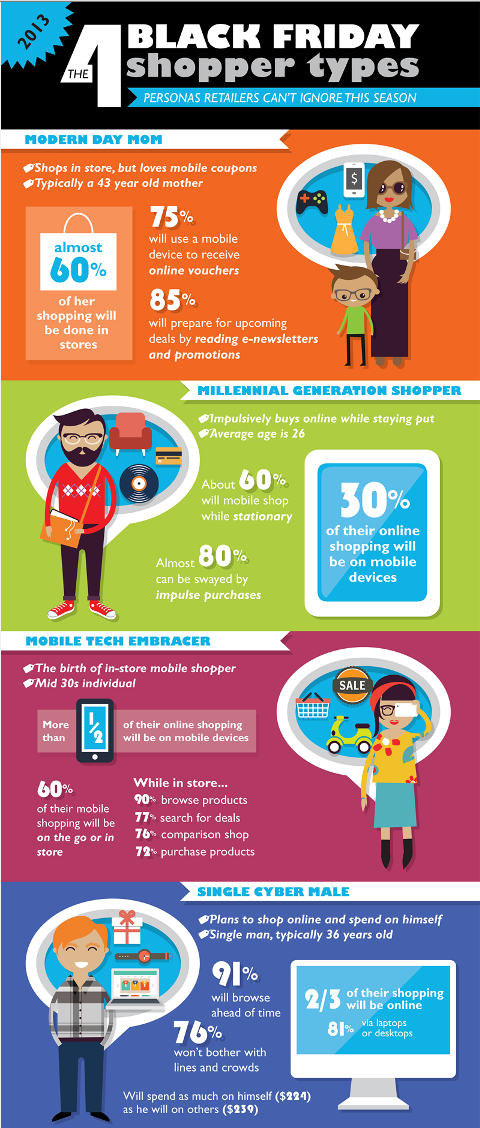

So not surprisingly, people have already thought about this. They’ve considered who their customers are and how they shop. Case in point:

But this infographic doesn’t answer nearly all the questions I have about how consumers interact with the mobile platforms available to them. And, to the best of my knowledge, no one has yet (if you’ve seen/heard/read otherwise let me know @adilwali). So here’s what I want to know:

Are mobile shoppers browsing or searching for specific products? I want to know if consumers are passing time on their phones exploring what’s out there or just buying things they already need. Moreover, if consumers are browsing, are they then going back to their computers to actually buy? (This goes back to my question of CLV vs. CPA). According to an article by socialmarketingforum.net, one of the key barriers to mCommerce success is security concerns. Consumers aren’t convinced that transactions on their phones are as secure as on their computers. I expect this will change as digital wallets become more prevalent and a stronger resource for internet retailers.

How much more interrupted is the shopping experience? I want to know if orders placed on mobile devices are generally larger or smaller than orders placed on computers. IBM average sales numbers put tablets about equal with computers and smartphones just below in terms of amounts spent. How does this break down for product quantities? Which brings me to my next question: if viewing real-estate matters, how do you know that the size of the screen isn’t a key contributing factor to lower AOVs (average order values)? The numbers this year show that while sales have gone up, AOVs have gone down – how much does this have to do with the rise in mobile shopping for the holiday season? The same socialmarketingforum article cited above also mentions that even though consumers like the convenience of mobile shopping, they prefer the resolution and size advantages of viewing products on a desktop. It’s harder to judge an object the smaller it is. The real question here may be about merchandising versus experience. Do different numbers reflect the different experiences of mobile vs. desktop shopping? Or should retailers be merchandising their products differently across different platforms?

Finally, while visioncritical.com has broken down four shopping archetypes, who are they missing? How do the different archetypes interact with mCommerce. If the mom is usually looking for coupons, what’s the college-aged female looking for? How can retailers adapt their mobile platforms to best meet each archetypes needs?

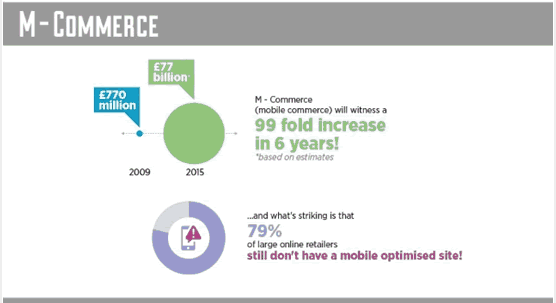

To sum this all up, I’ll leave you with some more numbers. mCommerce is going to keep growing and companies need to start gathering the data that will allow them to maximize their mobile potential.