Hi, I’m Adil Wali. I became a Microsoft certified professional at age 14 and started my first web development company. That led to a career as a serial entrepreneur, advisor, and startup investor. I got my first “real job” at 33, and I’m now a FinTech executive with a passion for the markets.

It’s been a rough few weeks in the market, and I don’t believe it’s getting better for a while longer. I hate to join many others in sharing my pessimism about the near-term, but all the indicators I follow point toward a meaningful pullback. But while the timbre of other commentary is laced with fear and a “gird your loins” mentality, I see a huge opportunity for building generational wealth. Here’s what I’m doing with my own portfolio and how you can make a market pullback work for you.

PE Ratios and What they Mean for the Market

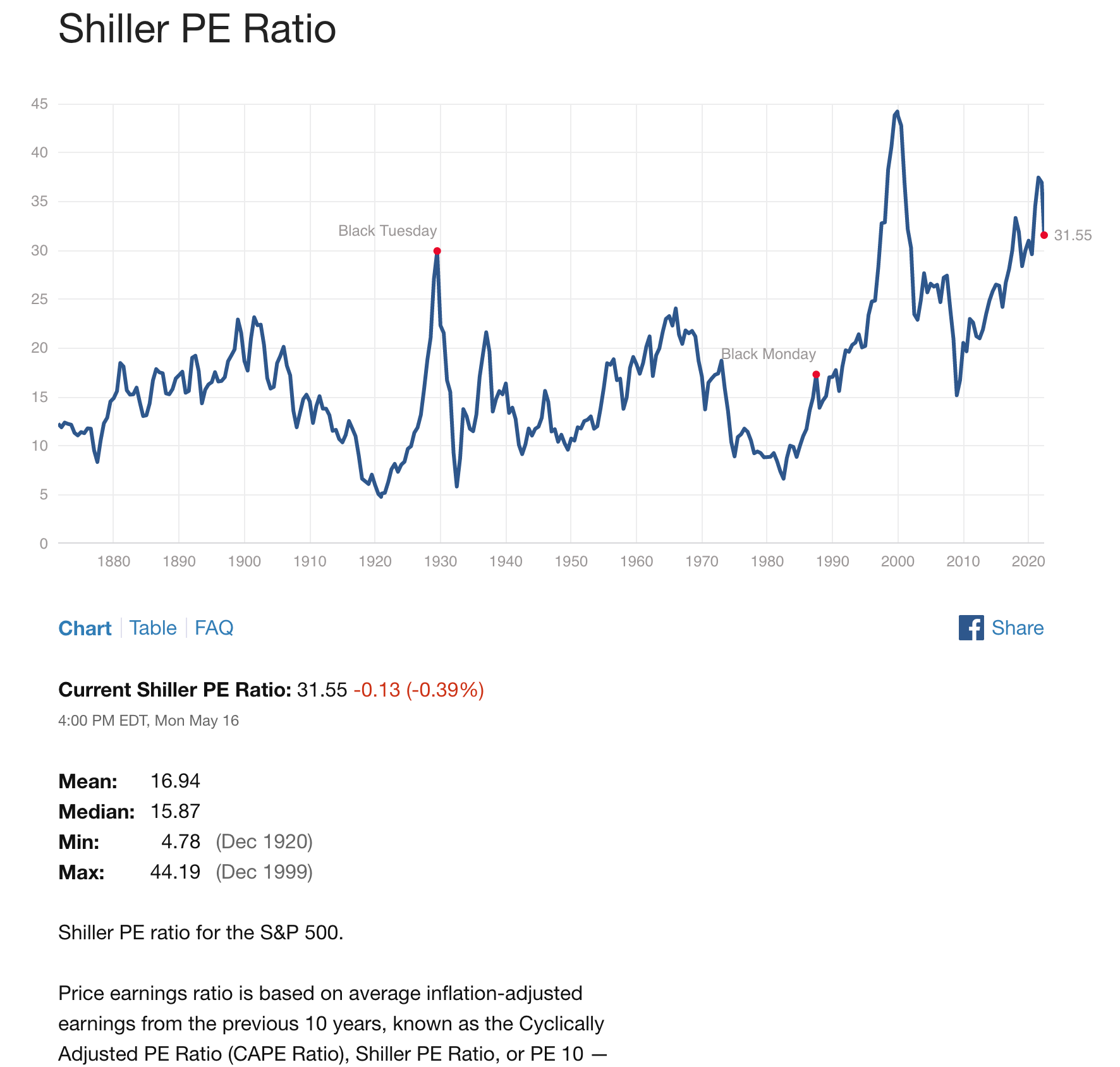

To put things into context, we need to start with the cyclically adjusted price to earnings ratio (sometimes called the Shiller PE ratio after Robert Shiller). This ratio is calculated by dividing the price of a share of a stock by the company’s earnings per share of stock. The higher the number, the less of a “deal” you are getting on a stock.

The Shiller PE ratio currently stands at 31.55, more than double what it was at the bottom of the 2009 bust. It is almost even with PE ratios before the Great Depression, and markedly off the highs that preceded the dot com bust in 2001.

What does that mean? It means that companies are still valued at some of their highest PE ratios ever, even after a meaningful pullback from their meteoric levels of 2020 and 2021. Bottom line: there is more room to come down, with the historical graph favoring 15-25x earnings.

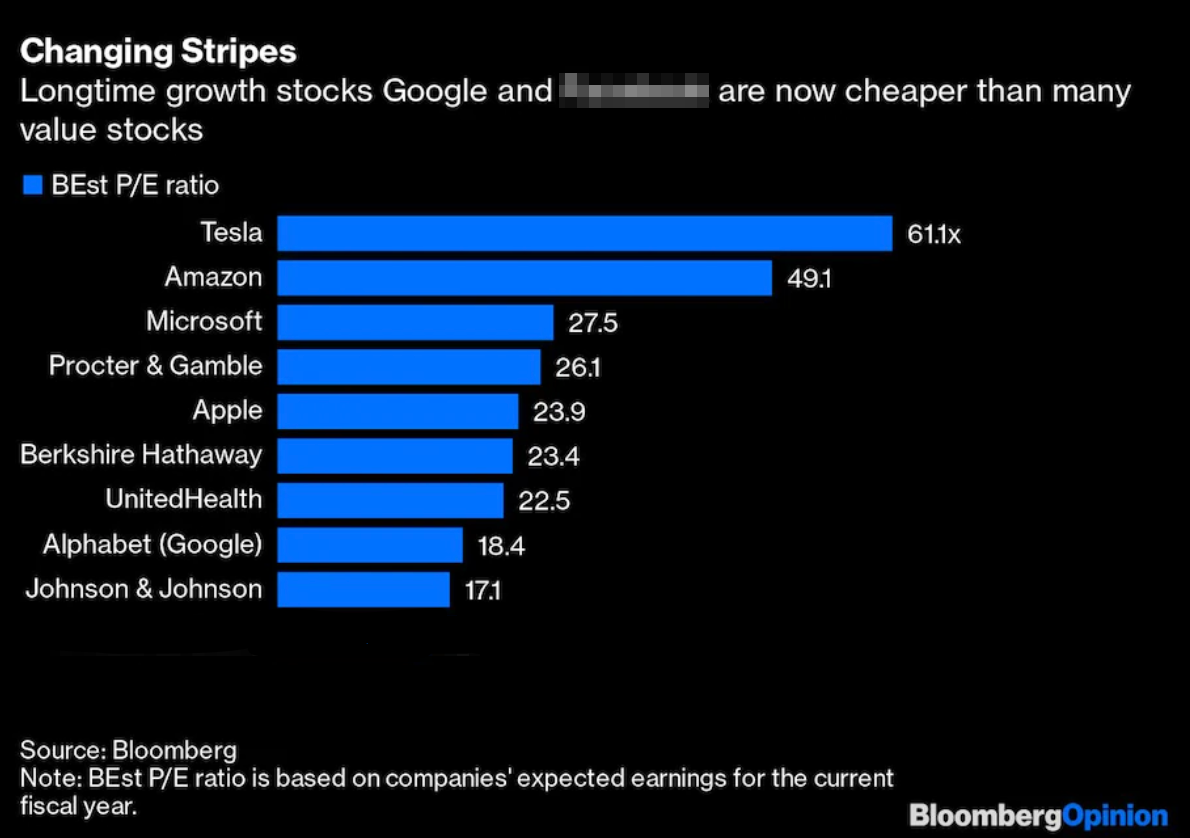

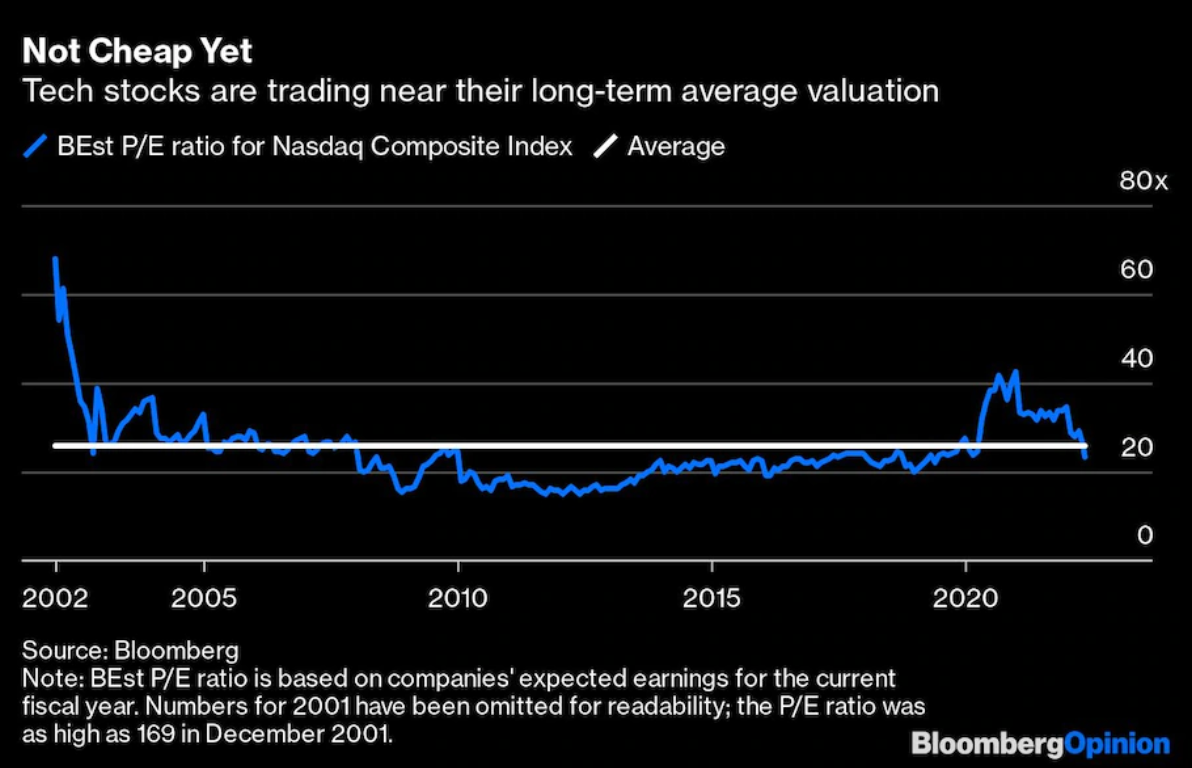

Top tech stocks are already back in the 15-25 PE ratio with the exception of Amazon. That leaves the rest of the market lots of room to come down to just get us back to historical averages. And as the Washington Post points out, tech stocks were trading below average PE ratios for pretty much all of the 2010s. Just because they’ve come down significantly doesn’t mean they don’t have more room to fall.

Other Factors Weighing Down the Market

In addition to PE ratios coming back toward average, we are still facing high inflation and interest rates that will continue to rise for some time. The Fed is considering raising rates another .5% at both its June and July meetings, which translates into big impacts for the most expensive items Americans buy, namely houses and cars, and causes business owners to rethink borrowing, spending, and investing.

What the Rest of Q2 May Look Like

Nothing goes up or down in a straight line, and we should expect a bounce in the weeks to come but ultimately we’re looking at another leg down overall in the markets.

Pullbacks typically don’t end until there is a capitulation of some sort, leading to spikes in volatility and major drops. We haven’t seen this so far – selling has been pretty controlled. This leads me to believe that we’ll see more contraction overall before we hit the bottom, but it’s likely to have periods of upward movements and sideways chopping before we fully bottom out.

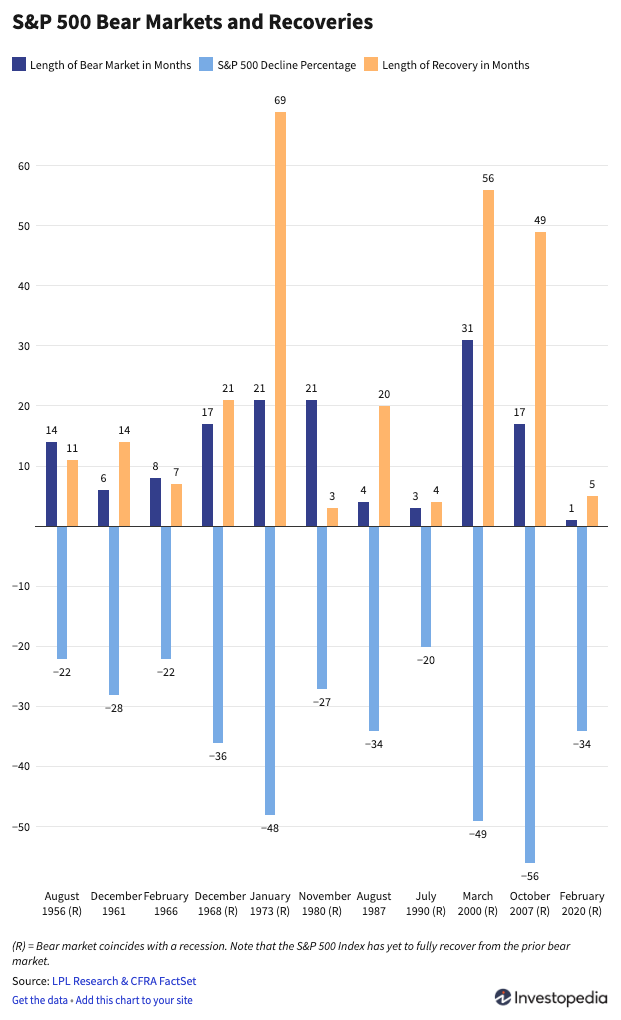

My other reason for believing that we’ll see more downward momentum is that while we are just now flirting with a bear market, they last an average of 12 months, meaning that once stocks decline into bear market territory, they will stay depressed on average for a year. We are just entering what is likely to be a painful 12-18 months for many people.

4 Ways a Market Pullback can be a Good Thing

For many investors, a market pullback can be a huge opportunity, not a catastrophic event. That’s not meant to trivialize the impact on portfolios, retirement prospects, and the like, but for the right person, it can be a real game-changer. Here’s how a market pullback creates opportunity:

1: Brings stock prices back in line with earnings, making cheaper buys

When you bring down a stock’s PE ratio, the stock gets cheaper, and you can buy more for the same money. Pullbacks inevitably tamp down PE ratios, making the same stock cheaper to own without any change to that company’s fundamental health or longevity.

2: Smaller, more frequent pullbacks cause less pain

Pullbacks are healthy for the stock market. Without them, the bubble gets bigger and more brittle until there is a seismic event. Because humans are terrible at contemplating bad events and negative future outcomes, these major downturns cause more real-world harm than smaller, more frequent contractions.

3: Constraints breed discipline

Businesses will get stronger for the constraints imposed on them by lower valuations and more picky investors. Hardship breeds efficiency and discipline in large and small companies alike, and ultimately make the companies that survive stronger.

4: Supply/demand imbalances for workers fade away

Many early-stage startups will not weather the coming storm. That will release new workers into the job market, opening up a chronically-constrained labor pool today. If the balance of power shifts from workers to hiring managers, we will see more productivity, less time and effort spent on hiring efforts, and less attrition in the remaining companies. That makes them stronger and better stocks to hold onto as the market swings back up in future years.

Who Can Benefit from a Pullback

The short answer is: not everyone. There are three groups of people for whom a market downturn can offer a big chance at building wealth. They are:

- Younger people with the bulk of their earnings ahead of them

- People with a high risk tolerance, who are willing to make big bets

- People with cash to play with, who can buy into the market when prices are at or near their lows

Let’s break that down a bit further.

Young People

If you have a lot of working years ahead of you, the majority of your earnings are likely to come. With this position, you can take bigger risks with the money you have invested, because you will be able to replenish it and continue adding to your stockpile as the years go by. If you are unencumbered by financial responsibilities like a mortgage and children, you may have more free cash to play with right now. The major caveat to this is that so many young people are carrying enormous student debt, but with the Covid-induced pause on student loan payments, you may have a chance to redirect some of that money into the market. Above all, be prepared to restart payments in August when the freeze expires.

People with High Risk Tolerance

Let’s be honest – it’s impossible to predict exactly when the bottom is going to hit, and anyone playing the game right now needs to recognize their chance of buying and watching their investments continue to slide for a while. I personally believe the bottom will hit in late summer / early fall, but that’s not stopping me from making small buys right now. I am also a recovering risk addict, so this strategy may not make sense for all. Bottom line: this is one of the opportunities in life where you may lose a lot, but you may also triple your money over the long term.

People with Dry Powder

To make any of this work, you have to have money sitting around ready to be invested. Not everyone is in this position, of course, but if you have been saving without a real plan, and you have some risk tolerance, this can be a great time to put that money to work.

How to Take Advantage of a Market Pullback

If you’re in one of the groups who can make the best use of this pullback, you need a plan for getting into the market. Here’s what I’m doing to take advantage of the market downturn.

Dollar Cost Average Buy Stocks

“Dollar cost average” means setting a plan for buying a stock, either a total amount of money or a total number of shares, and spacing out when you make your purchases. This lets you average the cost per share that you spend and smoothes out the highs and lows. So say you want to own 60 shares of a particular stock and you think that the market is going to turn around in July…you could create a spreadsheet or a calendar reminder and purchase 20 shares at a time regardless of the cost on days that you determine in advance – once a month, perhaps. You won’t make as much as if you had purchased all the shares at the very bottom, but you will have more upside than if you had purchased all the shares as it is going up. You lose some upside, but you also protect yourself from losing more if the stock turns the other way.

Focus on Discipline and Profitability

There are some stocks that have tiny PE ratios despite having excellent business fundamentals. These are the stocks you want to seek out, the ones who are generating stable profits and where the underlying premise of the business is sound. These may not be the most flashy stocks or get much airtime, but they are solid buys that will be great long term.

When to Make a Move

If only I knew for certain…It’s a guessing game, but one you can play with strategy. Stocks do not all bottom out at the same time, so if you are investing in individual equities, you can’t look at the market as a whole to decide when to make your moves.

Higher quality stocks (the ones you are looking at with that focus on discipline and profitability), will bottom first, and possibly won’t draw down as much as others. If you are seeing a flattening or an upturn in stocks you plan to buy while others continue to go down, it could be the right time to buy in, using the dollar cost average plan. That protects you if the rising prices are a fluke with minimal tradeoff.

Key Takeaways

To recap, we are teetering on a bear market, with some stocks already pulling back heavily and others with a way yet to go. We are seeing PE ratios come down but stay elevated compared to historical averages. We are seeing high inflation and rising interest rates. We are likely to see much further downturns in the overall market in the coming months.

This creates opportunity for investors ready to make big moves and able to think long term. For young people, people with a high risk tolerance, and those with cash available to invest, there’s a chance to create generational wealth if you are careful about timing your entry into the market using techniques like dollar cost averaging and focusing on stocks with strong financials and operational discipline.

Remember that stocks will bottom at different times, and there is always a bull market somewhere!

Disclaimer: Adil.io does not provide, and no portion of our Content purports to be, individualized or specific investment advice and Adil.io does not provide investment advice to individuals. All information provided by Adil.io is general in nature and is made without regard to individual levels of sophistication or investment experience, investment preferences, objectives or risk parameters and without regard to the suitability of the Content for individuals or entities who may access it. No information provided by Adil.io should be construed as an offer to sell, or a solicitation of an offer to buy any security or investment vehicle, nor should it be construed as tailored or specific to you, or any reader or consumer thereof. You understand and agree that our content does not constitute specific recommendations of any particular investment, security, portfolio, transaction or strategy, nor does it recommend any specific course of action is suitable for any specific person or entity or group of persons or entities. Adil.io research Content is based upon information from sources believed to be reliable. Adil.io is not responsible for errors, inaccuracies or omissions of information; nor is it responsible for the accuracy or authenticity of the information upon which it relies.