Hi, I’m Adil Wali. I became a Microsoft certified professional at age 14 and started my first web development company. That led to a career as a serial entrepreneur, advisor, and startup investor. I got my first “real job” at 33, and I’m now a FinTech executive with a passion for the markets.

Our views have remained consistent throughout the year, and we reiterate them today. We started our January 2022 letter saying: It’s been a rocky start to the year, and while some believe we’ve hit the bottom already, we feel the potential for a downside move is not yet over. In our March 2022 letter, we reiterated our view that the downside catalysts remain unchanged, and in some cases are getting worse: (1) slowing corporate earnings, (2) oil and other commodities continuing to trend up, (3) the Fed tapering, (4) an unclear resolution to geopolitical tensions.

Turning our attention to the last month and this month, it’s noteworthy that the market has trended slightly up (+1.52%) while VIX has trended meaningfully downward (-24.02%) in the last 30 days. This is particularly telling because we’d normally expect the market to rally massively on such a collapse in VIX. We’re likely not seeing that rally because the market is holding its breath for the upcoming catalysts: FOMC and VIX expirations on 6/15. Quarterly options expiration on 6/17.

Given the very bearish sentiment and crowded market positioning, we actually think the balance of probabilities favors a small upside surprise after these expirations. (Perhaps to ~4300 on the SPX) This would be a good time to see the commodities complex pause and backfill a little bit as well.

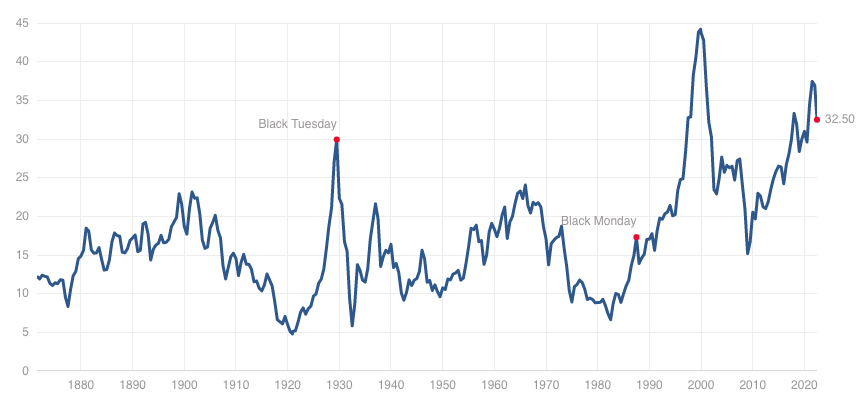

And we believe such a rally in equities is worth selling. Our macroeconomic model continues to show the balance of probabilities is in favor of the bottom not yet being in for this bear market. A simple look at the Shiller PE Ratio tells you that we’re simply not there yet in terms of this market being cheap from a valuation perspective. Note that it’s currently about double where it was as the bottom of the 2008 break market:

We do think it’s possible that the market could bottom in the second half of the year. This outcome would depend considerably on the decisions of the Fed, how much corporations tighten their belts, and if the market shows the signs of true capitulation. We’re looking for meaningful stress in corporate credit markets, a major spike in the VIX, and perhaps most importantly, the Fed ending the charade of sustained interest rate hikes “well into 2023.”

We reiterate our downside target for the S&P 500 being 3250, which we think could happen this year. Given that we expect the Fed to print again and spark a late-year rally, our EOY price target continues to be 4450.

Disclaimer: Adil.io does not provide, and no portion of our Content purports to be, individualized or specific investment advice and Adil.io does not provide investment advice to individuals. All information provided by Adil.io is general in nature and is made without regard to individual levels of sophistication or investment experience, investment preferences, objectives or risk parameters and without regard to the suitability of the Content for individuals or entities who may access it. No information provided by Adil.io should be construed as an offer to sell, or a solicitation of an offer to buy any security or investment vehicle, nor should it be construed as tailored or specific to you, or any reader or consumer thereof. You understand and agree that our content does not constitute specific recommendations of any particular investment, security, portfolio, transaction or strategy, nor does it recommend any specific course of action is suitable for any specific person or entity or group of persons or entities. Adil.io research Content is based upon information from sources believed to be reliable. Adil.io is not responsible for errors, inaccuracies or omissions of information; nor is it responsible for the accuracy or authenticity of the information upon which it relies.