Hi, I’m Adil Wali. I became a Microsoft certified professional at age 14 and started my first web development company. That led to a career as a serial entrepreneur, advisor, and startup investor. I got my first “real job” at 33, and I’m now a FinTech executive with a passion for the markets.

September was a rough month for the equity markets, with the S&P 500 (-9.34%) and Nasdaq (-10.61%), marking the worst monthly decline since March of 2020.

In our April letter, we called for a 3250 downside target on the S&P 500. In our June letter, we said that we’re keeping our eyes open for an unexpected rally based on a news catalyst as it wouldn’t take much. And we got one. And, in July, we framed three possible shapes of the market in the back half of the year. With the action we got in August and September, we were able to safely rule out both the sideways chop and the bottom being in scenarios (2 and 3 below, respectively.)

- The market having a vicious snapback rally and then resuming its trend downward.

The marketchopping sidewaysfor a while before continuing to trend down.- The bottom being established for this bear market and a resumption of the bull trend.

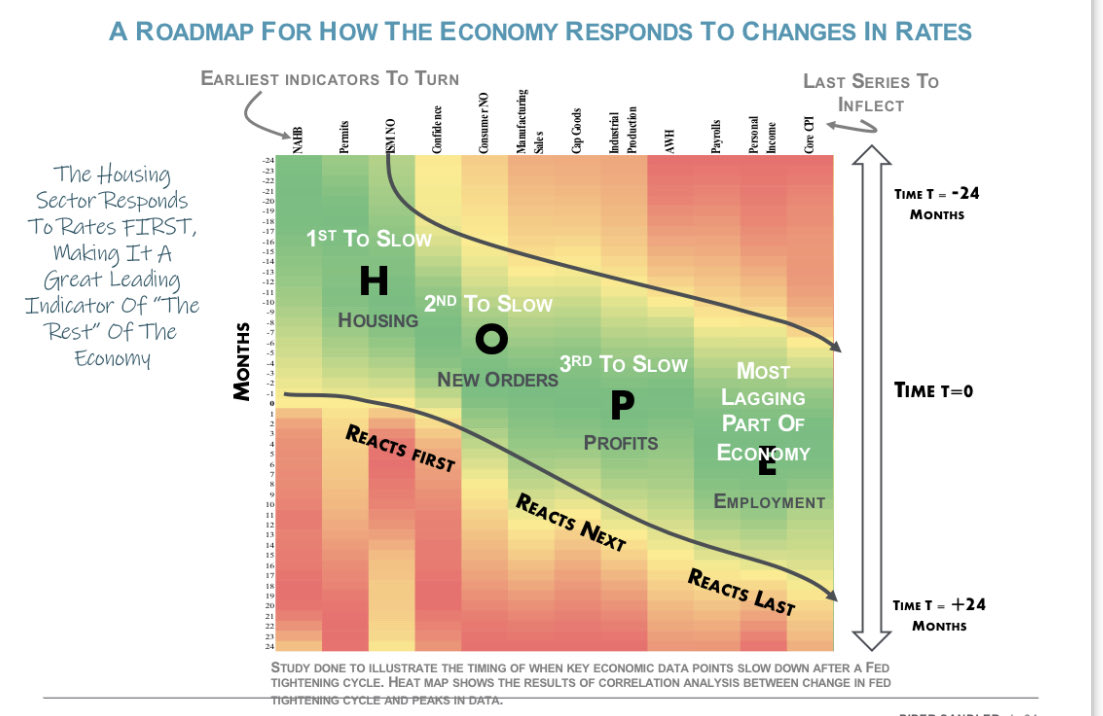

Now the question is: how much further down will we go from here? And, of course, it’s worth thinking about when we might bottom. We shared the HOPE framework in our last letter, and continue to believe it’s a good framework to follow.

The next shoe to drop, in theory, is corporate profits. And, despite the fast drawdown of the markets, we’re not convinced that corporate profits will drop as fast as everyone expects. This could fuel a rally through the first part of Q4, with sentiment being as bearish as it is. (We’re reminded of June!) Remember, nothing goes up or down in a straight line. And, in general, cascading effects of a strong dollar and higher interest rates take time to play out.

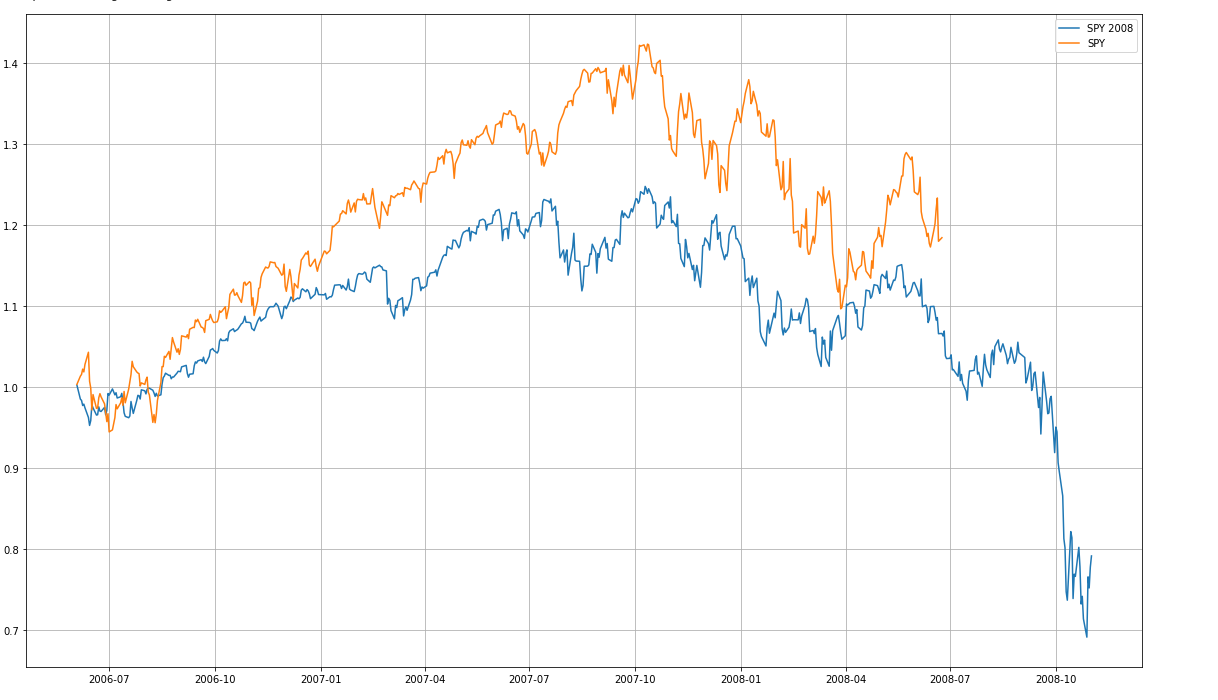

While the past is not always a great predictor of the future, we think it never hurts to look back at other major market drawdowns and see if we can learn anything. We decided to look at the shape of the 2022 market (orange) with the 2008 market (blue), here’s how it looks:

While they were not identical, we were surprised at the similarities in the charts. Of course, it’s clear that if the rest of this drawdown plays out like 2008, we’re not done yet. In theory, however, a lot is different now than in 2008. For starters, we don’t have a specific sector (eg., housing) that is so overextended that it risks the broader banking system. Instead, we seem to have had an abundance of liquidity that is now draining out of the system.

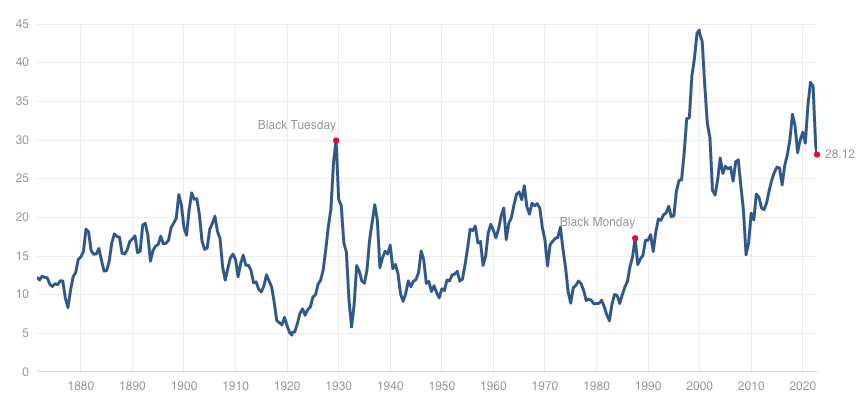

While our view is that this may not necessarily be as bad as 2008, we don’t think we’ve hit the bottom yet. Note that the cyclically-adjusted P/E ratio (CAPE) is still 65% higher than its ~140 year mean.

So, when might we expect a bottom? Our current models suggest sometime in the first half of next year. We reiterate our SPX bottom call of 3250 and are revising down our EOY target to 3650.

Disclaimer: Adil.io does not provide, and no portion of our Content purports to be, individualized or specific investment advice and Adil.io does not provide investment advice to individuals. All information provided by Adil.io is general in nature and is made without regard to individual levels of sophistication or investment experience, investment preferences, objectives or risk parameters and without regard to the suitability of the Content for individuals or entities who may access it. No information provided by Adil.io should be construed as an offer to sell, or a solicitation of an offer to buy any security or investment vehicle, nor should it be construed as tailored or specific to you, or any reader or consumer thereof. You understand and agree that our content does not constitute specific recommendations of any particular investment, security, portfolio, transaction or strategy, nor does it recommend any specific course of action is suitable for any specific person or entity or group of persons or entities. Adil.io research Content is based upon information from sources believed to be reliable. Adil.io is not responsible for errors, inaccuracies or omissions of information; nor is it responsible for the accuracy or authenticity of the information upon which it relies.