Hi, I’m Adil Wali. I became a Microsoft certified professional at age 14 and started my first web development company. That led to a career as a serial entrepreneur, advisor, and startup investor. I got my first “real job” at 33, and I’m now a FinTech executive with a passion for the markets.

August was a very interesting month for the markets, marked with meaningful volatility with a ~9% range from the high and low of the month. The ultimate question that the market was (and maybe still is) trying to answer: Was the recent rally a bear market rally or the beginning of a new bull market?

As we mentioned in the last letter, the dispersion of likely future outcomes is the highest we’ve seen in a very long time. The market’s recent run-up showed us that buyers are still capable of being out in force and that the money on the sideline is ready to put to work when the time is right. That’s not to mention, some companies may be racing to get in buybacks before the new taxes land next year. Yet, at the same time, Powell’s got his work cut out for him and the continued tightness of the labor market doesn’t bode well for the near and medium-term inflation picture.

In our recent months’ letters, we’ve framed three possible shapes of the market in the back half of the year:

- The market having a vicious snapback rally and then resuming its trend downward.

The marketchopping sidewaysfor a while before continuing to trend down.- The bottom being established for this bear market and a resumption of the bull trend.

July’s market action helped us rule out shape 2. The tail-end of August increases the likelihood that shape 1 is in play. While shape 3 is still very much possible, the fact that we’ve recently broken the 50-day moving averages on all the major indexes reduces the likelihood that we are out of the woods yet. The bulls would need to retake this level quickly to muster up a comeback.

Powell’s recent straight-talk after Jackson Hole reaffirmed the message that we believe the market needed to hear: the Fed is taking inflation seriously… for now. While we think a Fed pivot is potentially still in the cards, we sense that it’s coming later than we originally anticipated. Sometime in the middle (or second half) of 2023 seems a lot more likely than any time in 2022.

The bigger question now is: Can the Fed engineer a soft landing? Our guess is that soft-ish is the best we can hope for, and that would require selective pieces of the CPI basket such as food and energy coming down in isolation. That and corporate profits must continue to remain relatively strong through the end of the year. We think this is possible, though less likely than the alternative, which is that we see broader demand destruction and an eventual dip in corporate earnings.

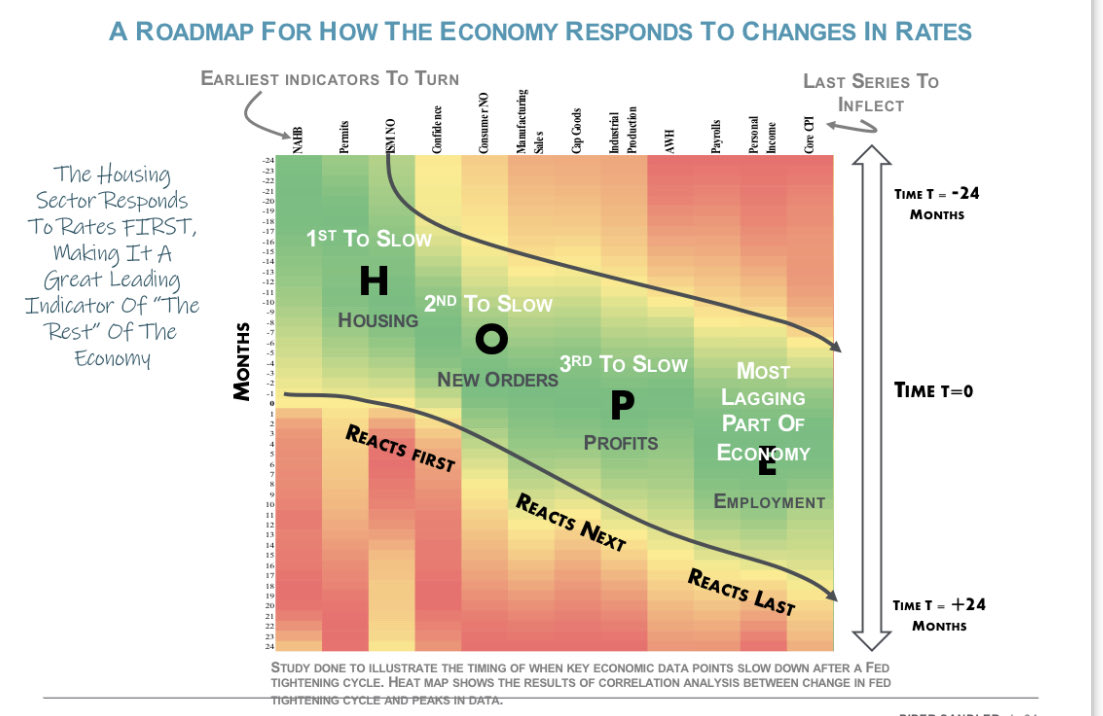

Piper Sandler’s chief investment strategist, Michael Kantrowitz, created the HOPE Cycle, which we find to be a helpful framework to understand how the economy responds to changes in rates. As you’ll see above, this framework suggests that Housing is the first thing to slow (already happening), then New Orders, then Corporate Profits, and finally Employment. If we follow this framework, we see that leading indicators for New Orders such as the ISM have been trending down throughout the year, as you’ll see below. That suggests that corporate profits are the next shoe to drop.

In our last letter, we mentioned that if we had to pick between our previous market bottom call of SPX 3250 and our earlier EOY target of SPX 4450, we’d stick to the bottom call of 3250. The primary change here is the timing. We originally believed this bottom had a high likelihood of occurring in 2022. While that’s still in the cards, the persistent inflation and recent rally have both increased the likelihood that the market actually bottoms in 2023 (if the bottom isn’t already in, of course.)

Even though we’d pick the bottom of 3250 over the EOY target of 4450, it doesn’t mean that we’re ready to revise down our EOY target just yet. The dispersion of likely outcomes still remains extremely high, and the next couple of months will be pivotal in defining the path forward. We are eagerly anticipating the CPI and PPI prints on 9/13 and 9/14 respectively. More immediately, this week’s ISM on 9/6 and Jobless Claims on 9/8 are also ones to watch.

Disclaimer: Adil.io does not provide, and no portion of our Content purports to be, individualized or specific investment advice and Adil.io does not provide investment advice to individuals. All information provided by Adil.io is general in nature and is made without regard to individual levels of sophistication or investment experience, investment preferences, objectives or risk parameters and without regard to the suitability of the Content for individuals or entities who may access it. No information provided by Adil.io should be construed as an offer to sell, or a solicitation of an offer to buy any security or investment vehicle, nor should it be construed as tailored or specific to you, or any reader or consumer thereof. You understand and agree that our content does not constitute specific recommendations of any particular investment, security, portfolio, transaction or strategy, nor does it recommend any specific course of action is suitable for any specific person or entity or group of persons or entities. Adil.io research Content is based upon information from sources believed to be reliable. Adil.io is not responsible for errors, inaccuracies or omissions of information; nor is it responsible for the accuracy or authenticity of the information upon which it relies.