Hi, I’m Adil Wali. I became a Microsoft certified professional at age 14 and started my first web development company. That led to a career as a serial entrepreneur, advisor, and startup investor. I got my first “real job” at 33, and I’m now a FinTech executive with a passion for the markets.

Cryptocurrency is supposed to be decentralized

Getting it all wrong

When Satoshi first wrote the Bitcoin whitepaper in 2008, she challenged the banking system as we know it. She draws reference to the inherent weaknesses of the trust-based model. The whole point was to build an ecosystem and economy that operated without these trusted third-parties. Yet, here we are, 10 years later, bastardizing that vision with gusto.

The dichotomy in our response, as a community, is quite curious. On one hand, we seem to understand these are really big ideas that have the potential to change banking and retail as we know it. This explains the total market cap of crypto being about $425 billion as of Feb 25, 2018. Yet, on the other hand, it appears as though a supermajority of digital currency users now use centralized exchanges like Poloniex, Coinbase, Bitfinex, Bitstamp, etc.

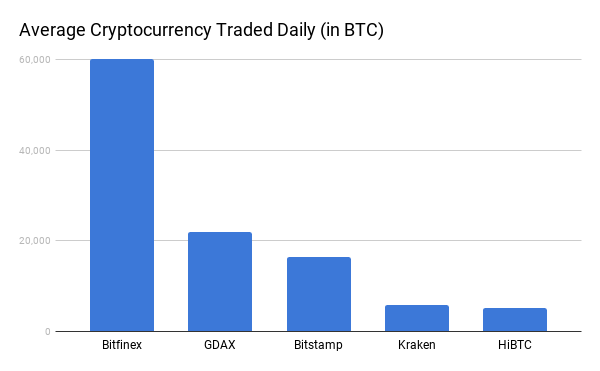

Our collective lack of technical depth coupled with growing interest in the space has led many crypto enthusiasts to these trusted third parties. Further, cash is still king in business, and these folks have made a lot of cash. And, smartly, they’ve reinvested it in the form of massive marketing budgets. Bitfinex is the trusted third-party to about 60,000 BTC worth of cryptocurrency trade daily. GDAX and Bitstamp, follow close with about 22,000 BTC and 16,500 BTC worth of crypto trade daily, while Kraken and HiBTC facilitate about 5,800 BTC and 5,200 BTC worth of crypto trading daily (chart above).

We’re not actually better for it

Perhaps the most ironic thing about digital currencies is that our misguided use of these centralized approaches does not actually result in that great of a user experience, as evidenced by:

- A hugely significant amount of money that has been stolen from centralized exchanges. (More on this below.)

- Some exchanges experiencing massive slowdowns during peak times. (Some caused, at least in-part, by congestion in the underlying networks of Bitcoin and Ethereum.)

- High trading volumes, or not being able to keep up with growth, leading to downtime on major exchanges.

The reason not to rely on trusted third-parties is that of all the ways in which our reliance on them can hurt us. Yet, here we are, getting hurt. It’s almost as if today’s users of digital currencies would be perfect posterchildren for Satoshi’s 2008 whitepaper.

The notion of privacy in crypto has also largely been a broken dream. And that’s at the protocol level. It does not even take into account how much we’ve made things worse with our centralized pattern of adoption. Coinbase being subpoenaed for the personal information of 14,355 holders by the IRS only adds insult to injury in this respect.

Centralization from the get-go?

ICOs are centralized too! In almost every case, those investing in an ICO are all buying from a central company or organization that they seemingly trust. This is a far cry from the way Bitcoin was originally built and launched into the community. First, we had a whitepaper. Next, we had working software. Finally, we had the creation of value. No one bought bitcoin from Satoshi LLC after she posted the whitepaper online for the first time.

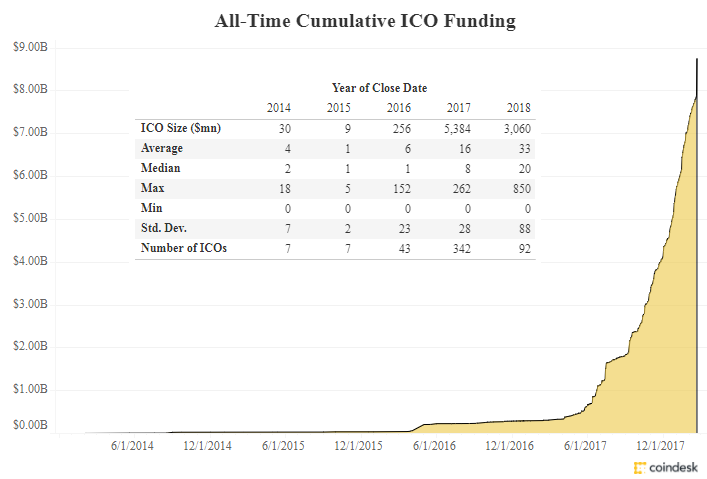

Bitcoin was launched in a pure way, with people organically growing the network on proven technology before ascribing value to it. Yet, here we are, investing in ICO after ICO, many of which have no technological progress-to-date. We’re not banking on a community or a network at these early decision points, but instead a central organization with an idea. The all-time cumulative ICO funding total stood at $8.74 billion according to CoinDesk as of February 19, 2018, with Telegram ($850 million), Filecoin ($262 million), and Tezos ($232 million) being the largest fundraisers.

2017 alone witnessed 342 ICOs raising about $5.4 million. The year 2018 has already seen 92 ICOs till date, with $3.1 million being raised. So, just two months into the year and we’re already recorded 57% of 2017’s total raise.

How much pain is too much?

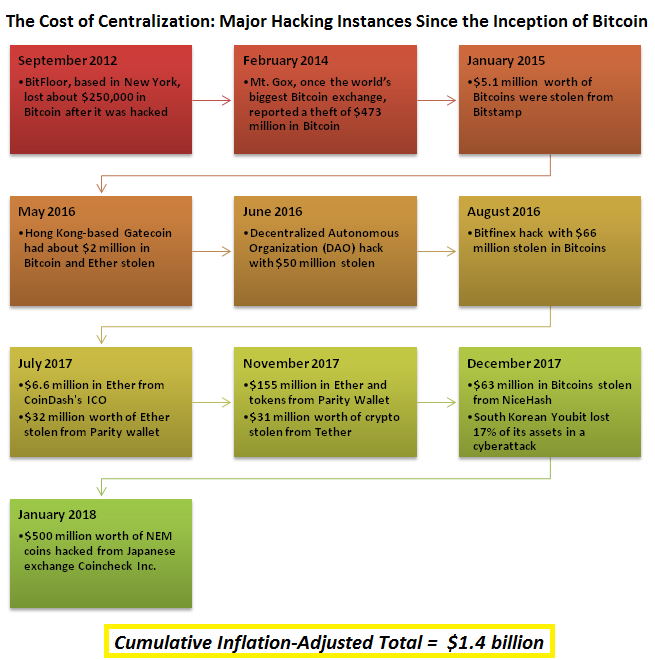

Apparently, the cost of trusting these third-parties is significant. Billions of dollars have been stolen from exchanges since Bitcoin launched in 2009 with almost zero accountability on the part of the exchange in nearly every instance. Here’s a quick view of what centralization has cost the cryptocurrency community since its inception:

When using the total market cap as a denominator, it appears that we are less safe with crypto than we were with old-fashioned money. Perhaps that shouldn’t be surprising, given that our collective behavior since this revolution started has been antithetical to its premise.

Where do we go from here?

I’m left wondering why. Why would we all believe in this game-changing vision with such fervor, and then proceed not to operate by its ethos? Maybe decentralization isn’t the killer feature of these technologies, after all. Maybe it is, and the community does not value it enough to actually use it. Maybe we just don’t like to practice what we preach. While those would be easy answers, they ring hollow to me.

Perhaps it’s that the usability of these decentralized technologies … leaves a lot to be desired. Let’s face it, blockchain is pretty unapproachable. Especially to folks who do not count themselves in the technical elite. Whether we’re talking about cold storage of your private keys or the fact that you are sending money to a 34-character alphanumeric string that you better not mistype, lest you lose your money.

So maybe, just maybe, there’s hope. Maybe we understand that decentralization is actually important. And, we’re just waiting for the usability of fundamentally decentralized approaches to actually get better. And, when it does, we will better align our actions with our beliefs. The alternative is a lot worse: our behavior is simply based on a fundamental misunderstanding of these technologies and their value. This would dangerous for all of us that believe in this technology and want it to win. So I, for one, am holding out hope that it’s the usability.

References:

- Cryptocurrency market capitalization data as available on CoinMarketCap.com

- ICO data from CoinDesk’s ICO Tracker <https://www.coindesk.com/ico-tracker/>

- Cryptocurrency exchange average trading volume data from Bitcoinity.org <https://data.bitcoinity.org/markets/exchanges/USD/6m#rank_desc>

- Andrea Tan and Yuji Nakamura, 2018, Bloomberg L.P. <https://www.bloomberg.com/news/articles/2018-01-29/cryptocurrency-markets-are-juicy-targets-for-hackers-timeline>

- Cheang Ming, 2018, CNBC <https://www.cnbc.com/2018/01/28/coincheck-nem-hack-unlikely-last-for-cryptocurrency-space-analyst.html>

- Frank Chaparro, 2017, Business Insider <https://www.businessinsider.in/Some-of-the-biggest-crypto-exchanges-are-shutting-out-new-users-because-they-cant-keep-up-with-demand/articleshow/62272509.cms>